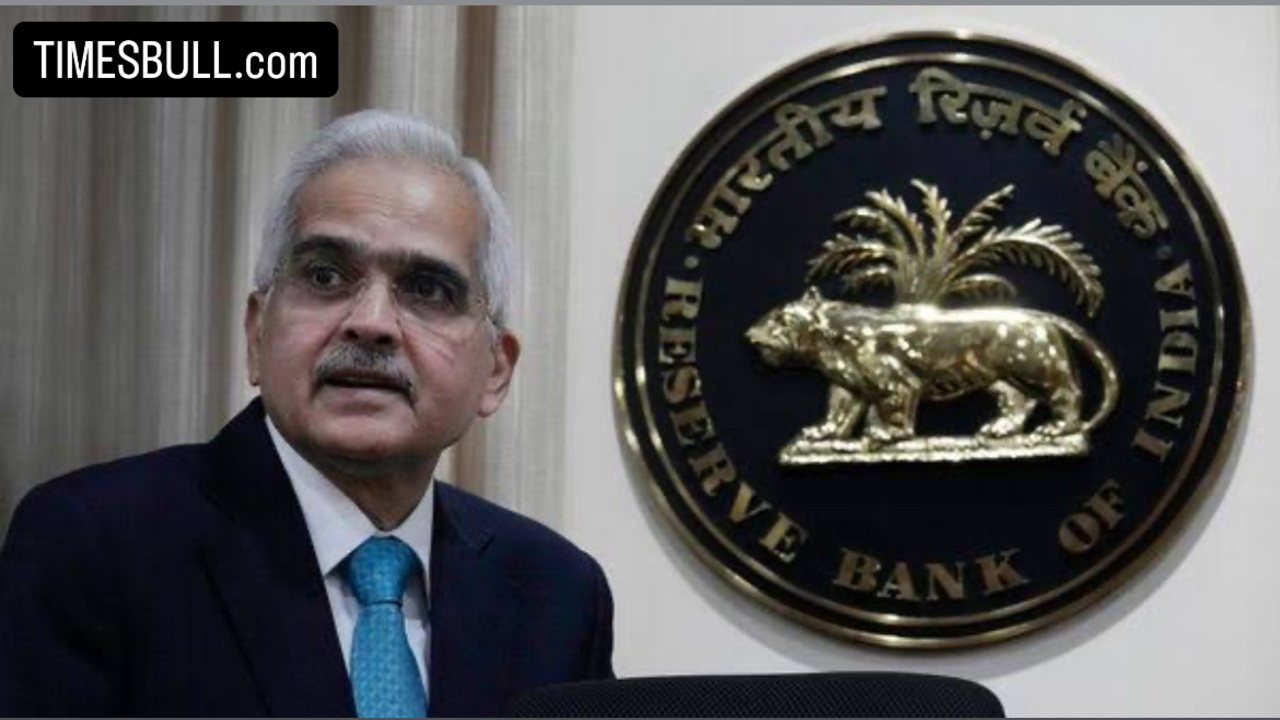

RBI will decide on monetary policy today, may decide to cut the repo rate by 0.25 percent

Judgement on monetary policy: The decisions taken at the first meeting of the Monetary Policy Committee (MPC) headed by new RBI Governor Sanjay Malhotra will be announced on Friday morning.

Experts have raised the possibility that the MPC may decide to cut the repo rate by 0.25 per cent after a gap of about five years. The repo rate has remained stable at 6.50 per cent for two years.

Rates started to rise in 2022

The last time the RBI had reduced the repo rate by 0.40 per cent to four per cent during the corona pandemic in May 2020. Then, to deal with the risks of the Russia-Ukraine war, the RBI started raising rates in May 2022 and this trend stopped in February 2023.

Senior economist Radhika Rao said this

Radhika Rao, senior economist at DBS Group Research, said, We expect the MPC to vote in favour of reducing the repo rate from 0.25 per cent to 6.25 per cent.

Global research firm Bank of America Global Research also said that the data on both economic growth and inflation point to the need to minimise monetary conditions. The decision to cut the interest rate by 0.25 per cent is expected to be taken unanimously.

Interest rate cut by 0.25 per cent expected

Industry body Assocham also said there is a broad expectation of reducing the policy rate to 6.25 per cent. A report by SBI Research said that the monetary review is expected to cut the interest rate by 0.25 per cent.

However, Amar Ambani, executive director of Yes Securities, said, We do not expect a rate cut by the RBI in this meeting. In fact, global conditions remain unfavourable for a rate cut at this stage.